The tax also decreases liquidity and increases transaction costs. This distortion would lead to investors holding certain assets longer than they should in order to avoid the tax. The country experienced a 60 percent decrease in trading volume as it moved to other markets, as well as a decrease in revenue.Īnother report from the Tax Foundation notes the tax can increase volatility and cause direct and indirect revenue losses.Ī financial transactions tax would distort asset markets, as types of securities traded more frequently would be taxed much more than assets traded less frequently. In fact, several studies conclude that an FTT increases volatility and bid-ask spreads and decreases trading volume.” …Sweden’s imposition of a financial transactions tax in the 1980s illustrates the challenges perfectly.

In 2012, the Bank of Canada studied the issue and concluded that “little evidence is found to suggest that an FTT would reduce speculative trading or volatility. It’s not clear that it would reduce volatility. …Supporters, however, argue that the Wall Street Tax Act is needed, because it would reduce volatility in financial markets. …That is why this tax would generate nearly $770 billion over a decade. Imagine this happening thousands of times a day. The $100 is being taxed twice: first, when the individual sells the stock, and then again when the money is used to buy the new security. For example, an individual might sell a stock worth $100 to diversify her portfolio and then purchase stock in a new company with that same $100. The same economic activity is taxed multiple times. Like a gross receipts tax, a financial transactions tax results in tax pyramiding. Policymakers should be wary about adopting a financial transactions tax. Some analysis from the Tax Foundation highlights some of the drawbacks from this tax. I don’t think there’s a tax she doesn’t want to impose and/or increase.īy the way, I should note that she and other advocates generally are looking at more limited FTTs that would tax transactions only in financial markets, so there wouldn’t necessarily be any direct burden when we write a check or visit the ATM.īut even this more restrained FTT would be very bad news, with significant indirect costs on ordinary people. Needless to say, I’m not surprised to see that AOC is on board. Republicans have a 53-47 majority in the Senate. Brian Schatz, D-Hawaii, in the other chamber. …The House bill comes on the heels of its companion legislation introduced by Sen.

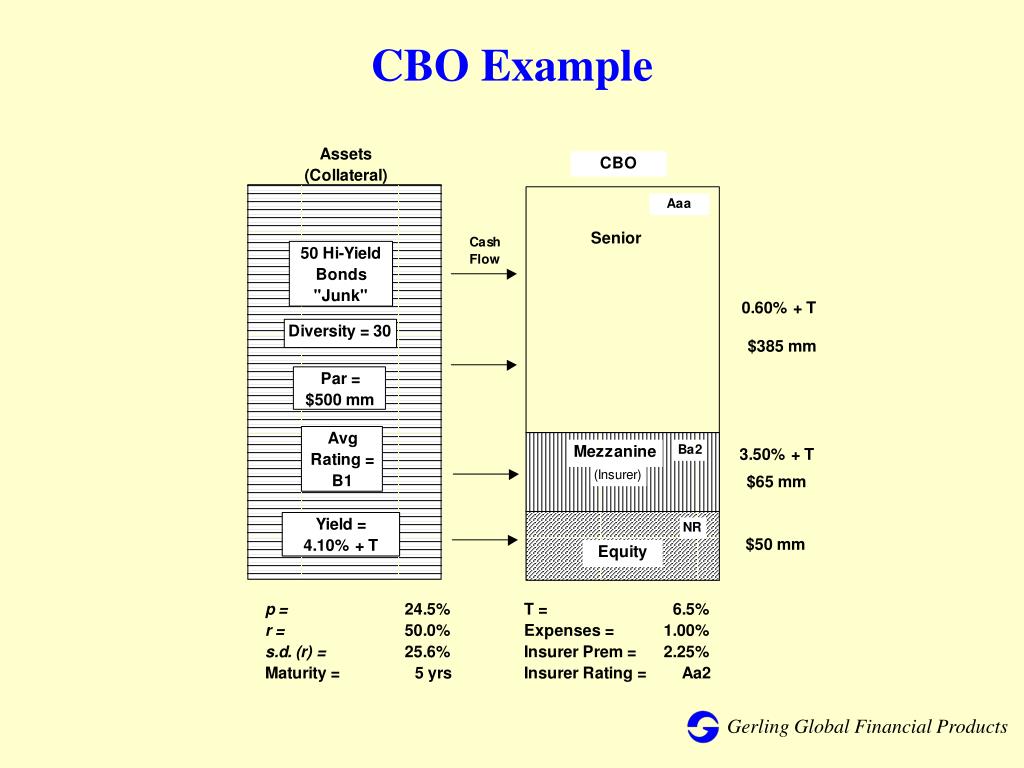

…“This option would increase revenues by $777 billion from 2019 through 2028, according to an estimate by the staff of the Joint Committee on Taxation,” the Congressional Budget Office’s website says. House Democrats are reintroducing their proposal of a financial transaction tax on stock, bond and derivative deals, and this time they’ve signed on a key new supporter: left-wing firebrand Rep. Other Democratic candidates have endorsed the idea, as has Nancy Pelosi, and CNBC reports that legislation has been introduced in the House and the Senate. It’s the “ Class Warfare Olympics,” and even Joe Biden is thinking about going hard left with a tax on financial transactions. While we have not verified the apps ourselves yet, our users have suggested 4 different CBO openers which you will find listed below.I was interviewed a couple of days ago about rival tax plans by various Democratic presidential candidates. Important: Different programs may use files with the CBO file extension for different purposes, so unless you are sure which format your CBO file is, you may need to try a few different programs.

#Cbo financial transaction tax how to

We are continually working on adding more file type descriptions to the site, so if you have information about CBO files that you think will help others, please use the Update Info link below to submit it to us - we'd love to hear from you! How to open CBO files While we do not yet describe the CBO file format and its common uses, we do know which programs are known to open these files, as we receive dozens of suggestions from users like yourself every day about specific file types and which programs they use to open them. However, different programs may use the CBO file type for different types of data. The CBO file extension indicates to your device which app can open the file.

0 kommentar(er)

0 kommentar(er)